Venture capitalists invested more than $6 billion in agriculture technology startups as part of an overall record year.

2020 Trends in Agriculture Investing

2020 Trends in Agriculture Investing

Selina Troesch | Touchdown Ventures

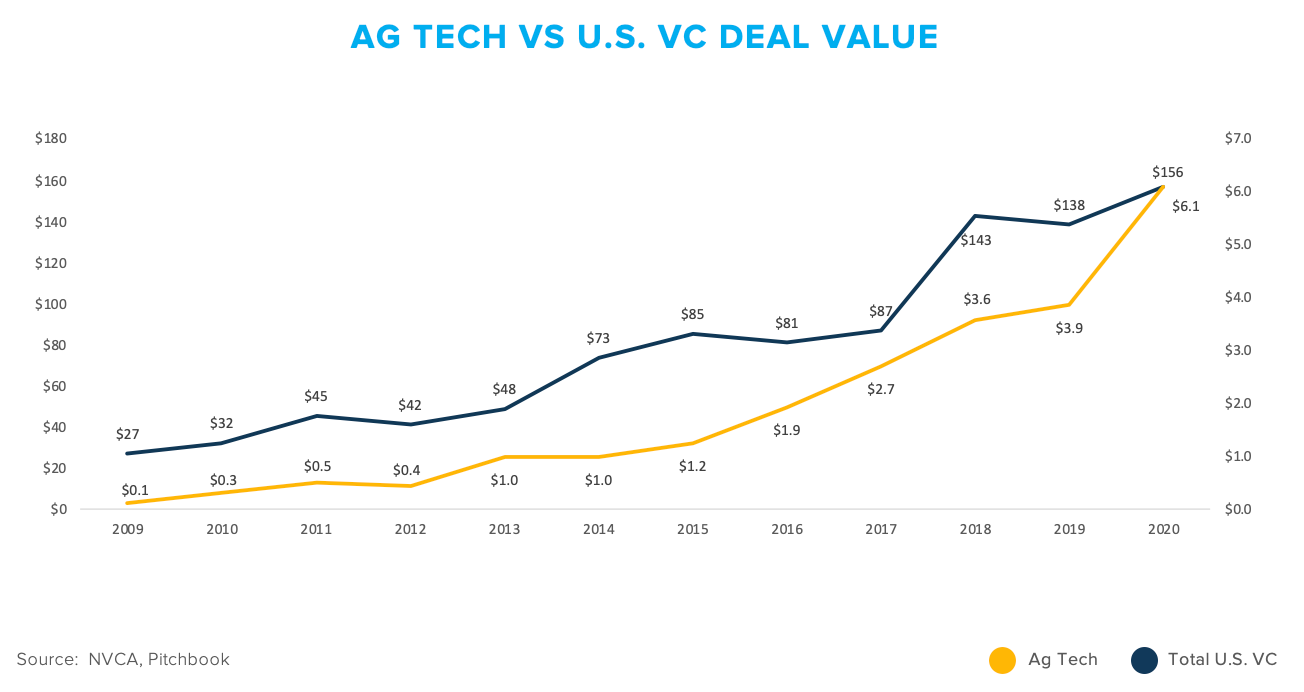

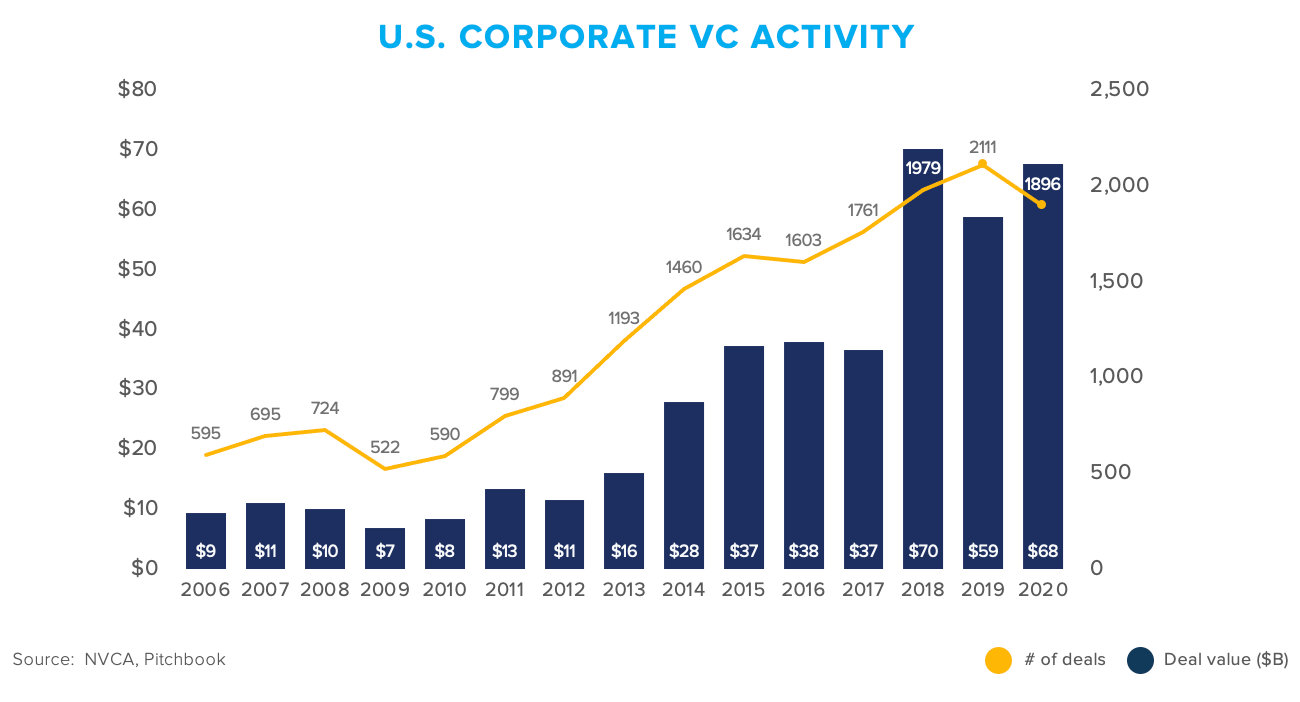

Predictions about venture capital diverged from reality in 2020, as PitchBook summarized last July. At the beginning of the pandemic in March of 2020, many of us anticipated that funding activity would slow down amidst the uncertainty of lockdowns, social distancing, and strains on the healthcare system. However, 2020 proved to be a record year for venture in the U.S., with $156B invested in startups and $74B raised by VC funds. Also contrary to what pundits might expect in a downturn, corporate VCs (CVCs) nearly matched their 2018 high water mark, investing $68B.

Agriculture tech (AgTech) startups received a record amount of venture capital in 2020, with $6.1B invested in companies in the category, a nearly 60% increase over the 2019 total. Drivers of this funding and overall trends in the AgTech market included:

- The global pandemic revealed weaknesses in the agriculture and food supply chain, which accelerated opportunities for entrepreneurs

- Greater focus on agriculture’s role in climate change created interest in solutions for “regenerative farming”

- Robotics, computer vision, and automation solutions were the greatest beneficiaries of the record levels of funding

Including data from PitchBook and NVCA’s quarterly Venture Monitor report, this analysis shares highlights from the U.S. VC industry as a whole, as well as statistics and observations specific to the AgTech startup market, based on Touchdown’s work with 1868 Ventures, the Scotts Miracle-Gro startup investment fund.

AgTech & VC Funding Highlights

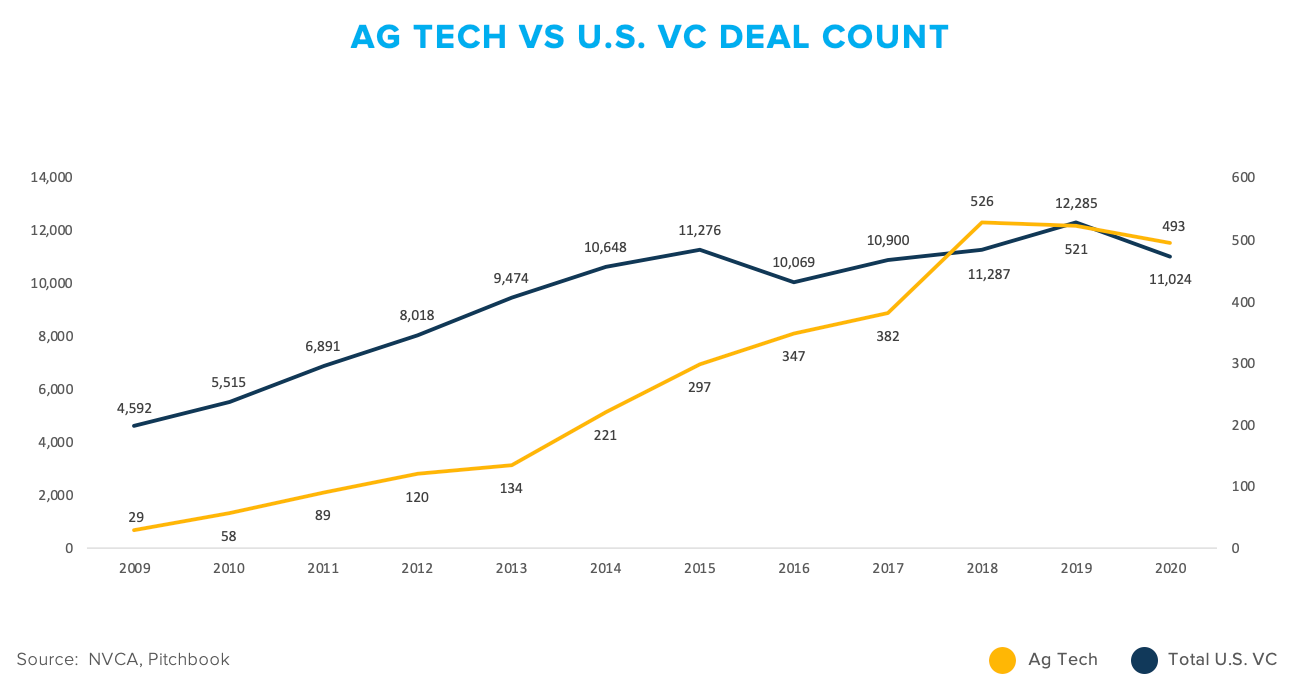

2020 was a record year for VC activity in the U.S., with $156B invested. However, the total deal count decreased from 2019, indicating that VCs concentrated funding in larger deals for fewer companies.

The AgTech sector mirrored the overall market, with $6.1B invested in 493 companies, a small decrease from the number of deals in 2019. In particular, deal value to “controlled environment” agriculture startups grew 168% in 2020, reflecting farmers’ focus on automation. However, AgTech funding saw a much greater percentage increase in funding value than the U.S. market as a whole, suggesting that sector specific factors created excitement among investors.

Here is the AgTech deal count compared to the overall U.S. market:

The global response to the coronavirus pandemic exposed a number of weaknesses in agriculture and the food supply chain that may have accelerated technology adoption and funding. In particular, labor shortages due to shelter-in-place orders and challenges adapting the supply chain to higher demand from consumers — as they shifted to cooking at home more often — applied pressure to the agriculture market last year. As a result, robotics, computer vision, automation solutions, and other technologies for broad acre and indoor farmers attracted record levels of venture investment.

Regenerative agriculture was another key sector for VC funding. These solutions help farmers manage soil health and water retention, create safer water runoff, increase farm biodiversity and resiliency, and capture carbon dioxide in soil. Growing focus on climate change likely contributed to VC interest in the sector.

CVC Highlights

In CVC, corporate funds deployed 48% by dollar value and participated in 26% of deals in the U.S. in 2020. As shown in the chart below, the $68B invested by corporations was nearly $10B more than 2019, which suggests CVCs stayed in the market despite economic uncertainty, as my colleague Scott Lenet forecasted in this post from 2019.

CVCs are an important source of capital for AgTech startups, particularly for R&D intensive products like fertilizers, soil amendments, and pest and weed controls. For startups developing such products, the expertise and scientific resources of big corporations can meaningfully accelerate commercialization. The following CVCs were most active in 2020:

- Cavallo Ventures, the investment arm of Wilbur Ellis, participated in seven AgTech investments in 2020, focused on the development of molecules that improve plant and animal outcomes.

- Syngenta Ventures also participated in seven AgTech deals in 2020 to advance the fund’s mission of sustainable agriculture.

- In addition to its healthcare focus, Leaps by Bayer participated in five AgTech deals that leverage the company’s genetic research expertise.

- FMC Ventures completed two AgTech investments in 2020, focused on pest control and soil health.

Notable AgTech Deals and Exits

- Agricultural service provider Indigo closed the largest AgTech round in 2020, a $500 million Series F in July. The company uses a genetic database to identify microbes most beneficial to crops. The Series F will support growth of the company’s carbon credit and grain marketplaces.

- Vertical insect farm operator Ynsect closed a $372.0 million Series C round in October with plans to expand operations globally. The company develops proteins and other insect based products for aquaculture, pet products, and fertilizers.

- Synthetic biology startup Zymergen closed a $350 million Series D in October. The company uses machine learning, big data, and AI to develop microbial alternatives to agricultural chemicals. The company filed for an IPO in March 2021.

- In February 2021, controlled environment agriculture operator AppHarvest exited to the public markets via SPAC, by merging with Novus Capital, raising an estimated $475 million in gross proceeds.

Agriculture Innovation In the News

- Spinach can send email — In the “strange but true” department, researchers have developed a way for spinach to communicate with them, potentially alerting scientists to contaminants and changes in climate.

- MIT researchers developed a method for growing plant cells in the lab — Similar to lab grown meat, the process could produce plant fibers in a lab environment, which could reduce resources necessary to grow food.

Article originally published on Medium.com.

This article includes information from third party sources believed to be reliable; however, we make no representations as to its accuracy or completeness. References to strategies are for illustrative purposes only and should not be relied upon as a recommendation to engage in any particular strategy or to invest in any particular security. Opinions expressed herein are based on current market conditions and may change without notice and we reserve the right to change any part of these materials without notice and assume no obligation to provide an update. Recipients are advised not to infer or assume that any securities, strategies, companies, sectors or markets described will be profitable or that losses will not occur. Any description or information regarding investment process or strategies is provided for illustrative purposes only, may not be fully indicative of any present or future investments and may be changed at the discretion of the manager. Past performance is no guarantee of future results.

The content & opinions in this article are the author’s and do not necessarily represent the views of AgriTechTomorrow

Comments (0)

This post does not have any comments. Be the first to leave a comment below.

Featured Product